Ringa Hora has worked with people from across industry to develop a shared roadmap to transform the Service sector workforce from its current state to the future that we aspire to.

The Workforce Development Plan looks across the Service sector and sets out the major factors shaping the sector and an overarching vision for the future.

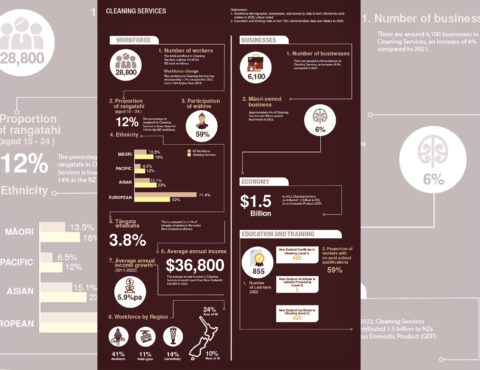

Against that context, this Action Plan focuses on the characteristics and dynamics of the Cleaning industry and its workforce. It describes what the future could look like for this workforce, the current challenges faced by the industry, and sets out the actions we can take to tackle this wero | challenge.

Ringa Hora’s Service Sector Workforce Development Plan is based on four aho | strands. Each of these aho will strengthen the workforce, but when woven together, as a taura whiri | rope, we can achieve real transformation of the workforce:

This is a future that embraces the demographic, cultural, and linguistic diversity that we know is characteristic of the Cleaning workforce (e.g. nearly a third of the current workforce are of Asian descent, and there is a strong migrant workforce).

It is a future where industry and the vocational education system recognise the skills and knowledge advantages that workers have from their previous work, educational, and life experience. Importantly, it means people can see and access a clear pathway for career and education progression from entry-level to supervisory and management roles. This includes business ownership, given the industry has a strong tradition of self-employment that is likely to continue.

The Cleaning industry supports a vast range of businesses, people and communities; it is an essential service which is becoming increasingly recognised and valued as one that ensures people can live and work in a safe and clean environment, whether that’s in commercial, domestic, or other public settings.

The Cleaning Services industry is one where much of the work is done out of the public eye (e.g. when the home, office, or other premises are vacant) and the results of cleaning are more apparent when the work is not done properly. Despite this low profile, the industry contributes nearly $1.5b to the nation’s economy and has immense value to society as an essential service. As observed throughout the pandemic, without cleaners the public is at risk of multiple health hazards and unsanitary living, working, and public environments.

The Cleaning industry is expected to have steady growth across both commercial and domestic areas. For commercial cleaning demand is expected to rise alongside profitability of businesses. For domestic markets the demands are driven by changing work patterns which means people have less time and are more likely to outsource cleaning tasks.

To help us get to the future state, we need to understand and tackle the challenges that the Cleaning industry faces, while also seizing the opportunities that already exist or are on the horizon. We’ve heard that the factors having a significant impact on the Cleaning industry, including its approach to workforce development include a labour and skills shortage, rising business costs and a gap in leadership roles.

Addressing skills and labour shortages

There are simply not enough people to meet current industry needs, from entry-level through to management. One reason for this is the significant number of transient workers in the cleaning industry; people who are specifically seeking short-term work in the industry and leave with no intention of returning. When looking at the pathways of employees who started in 2015, we can see that a third of people left the industry within a year, 60% had left within three years. In addition, the industry has an aging workforce with fewer young people being attracted into the industry. There are opportunities to shift this pattern and encourage slightly longer tenure, alongside efforts to attract more people to the workforce. The kinds of factors that we’ve heard as being associated with higher retention rates in the industry and wider Service sector include job stability, pay rates, work location and team culture.

Developing and recognising fit-for purpose training and qualifications

The industry is readily accessible, with 1 in 5 people entering without previous work experience

or qualifications. With almost all training delivered at work, the cleaning industry offers its workforce valuable opportunities to gain foundational skills that can prepare them to progress within their chosen careers.

Training needs to be able to keep up with industry changes and keep the workforce safe by adopting emerging practices – for example moves towards chemical free cleaning and the uptake of advancements in technology such as using virtual reality to find germs after “normal” cleaning with full sanitisation.

Recognising the impact of business cost increases

Increasing costs of business, including increases to product and machinery costs and the minimum wage, add pressure to employers and are perceived to deepen labour shortage issues. Wage thresholds for some visas that are based on the median wage (currently $29.66) exceeds what many industry employers can afford, in turn restricting their ability to attract migrant workers.

Addressing the gap in leadership roles

There is a gap in leadership, especially supervisory and operations management roles. This is acutely felt when cleaners are sick, as people in these roles often have to provide cover to compensate for the absence. This in turn puts additional pressure on an already stretched part of the workforce as they must juggle both responsibilities, or they are simply unavailable to provide that leadership.

There are approximately 28,800 people working in the industry but this could be almost a third higher, or around 36,500 people, if non-standard work patterns such as casual or very limited hours are included.

Embracing and celebrating diversity makes businesses more attractive to potential kaimahi, as well as creating economic and social benefits for employers,

the workforce, and the wider community.

Using workforce participation data as a starting point shows that there are some strengths in the Cleaning industry, but also that there is work to be done to realise the aspirations and potential of Māori, Pacific peoples, and tāngata whaikaha | disabled people:

![]()

There is a high proportion of Māori in the Cleaning industry. Recently, there has been an increase in Māori owned cleaning companies which tend to have a whānau based approach, hiring and support Māori within the industry. This, combined with recent changes where Government is promoting supplier diversity in cleaning contracts, has meant that there are increasing opportunities for Māori-owned businesses to unlock procurement opportunities and for Māori workers to own their own business in the industry.

![]()

There is a high proportion of Pacific peoples in the cleaning workforce. This may be because of the transient, flexible nature of the industry and the potential to start their own cleaning businesses. Pacific peoples make a positive contribution and play an essential role in the cleaning community. There is an opportunity to support individuals to progress within their chosen career pathways by ensuring on-the-job training is recognised and credentialised where possible so this experience and skills can support them wherever they go.

![]()

Tāngata whaikaha includes physical, mental, intellectual, or sensory impairments which can impact a person’s life to varying degrees and in different ways. The industry has a higher proportion of workers who identify as tāngata whaikaha (3.8%) compared with the total proportion of the New Zealand workforce (2.6%), although this is still a very low participation rate.

Explore Cleaning industry workforce demographic, business, and economy statistics, and education and training data.

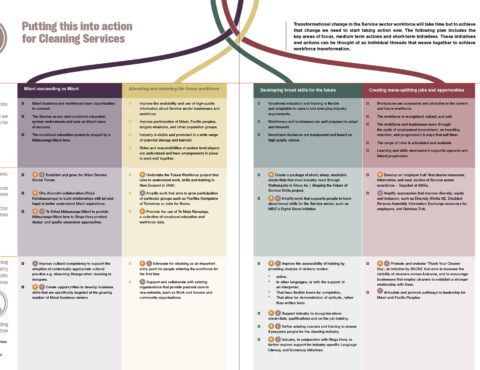

Transformational change in the Service sector workforce will take time but to achieve that change we need to start taking action now. The Cleaning action plan includes the key areas of focus, medium-term actions and short-term initiatives. These initiatives and actions can be thought of as individual threads that weave together to achieve workforce transformation.