This year our visual theme for each of the Industry Action Plans has been developed with a Te Ao Māori context in mind.

In Te Ao Māori, the Kea symbolizes manaakitanga | hospitality and whanaungatanga | relationship-building through its curious and intelligent nature. It embodies the spirit of guiding and caring for visitors, encouraging exploration while respecting the land. For tourism, the kea represents the journey of discovery, where adventure is paired with a deep connection to the environment and its stories.

The future of Tourism & Travel is evolving as customers demand more meaningful, connected experiences. Te Ao Māori is the future of tourism and travel as customers seek and value more meaningful connected experiences including histories, stories, world view, and cultural experiences forming an integral part of New Zealand’s identity.

The industry will adopt new and emerging technology, and embrace innovation to help their businesses grow and enhance the visitor experience.

The future workforce is one where individuals are ‘well equipped’, and have access to ongoing opportunities to upskill within their roles and develop in their careers2. This will ensure that the industry provides world class visitor experience and delivers benefits for all New Zealanders.

At its core, the Tourism & Travel industry connects people and provides them with a wealth of experiences all over the motu, ranging from leisure and recreational activities, entertainment, hospitality, retail, accommodation, and travel. Whether you are thrill-seeking in Queenstown, out for dinner in Christchurch, exploring the far North or enjoying recreation or shopping for clothing while travelling through Tauranga, the Tourism & Travel industry is there to support you.

Tourism is critical to New Zealand as one of our largest export industries and an important economic growth driver, generating $37.7 billion from visitor spending as of March 2023, an increase of 39.6% ($10.7 billion), and generating a direct contribution to GDP of $13.3 billion, or 3.7% of GDP, an increase of 30.9% ($3.1 billion)3. New Zealand tourism is now set to grow and expand beyond pre-pandemic levels, driving an increase in industry-wide revenue and profitability over the next five years4 with an anticipated surge of 35.3% in 2023-24, as international tourists return to New Zealand.

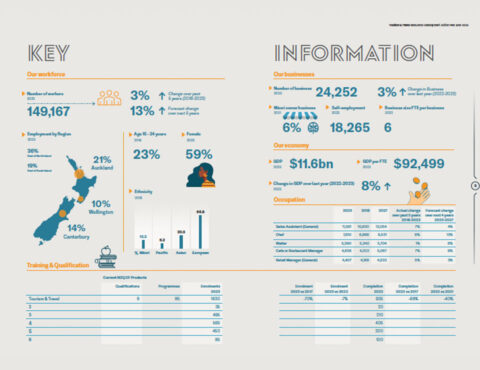

There are approximately 149,000 workers in the Tourism & Travel industry, excluding casual and part-time workers, as of 2023. It is estimated that this number will continue to grow by 2% per year in the near future, reaching 157,000 in 2025, and employing more than 166,000 people by 2028.

A high proportion of these workers are rangatahi (aged 15-24). It is expected that rangatahi will continue to make up a large proportion of the tourism workforce. Tourism Industry Aotearoa (TIA) has reported that two in five organisations are engaging with or planning to engage with secondary schools or tertiary providers to recruit staff. To support this, TIA have been holding a series of career expos, information sessions, internship programmes and gateway initiatives to promote career pathways into and within the Tourism & Travel industry.

There are a range of opportunities for rangatahi and the wider workforce to explore, especially for those interested in:

Although Tourism & Travel has rebounded strongly since the Covid-19 pandemic, businesses continue to struggle to fill the staff vacuum left, let alone meet the growth in demand. Shortages are particularly acute in towns and regions with large tourist numbers and relatively small labour markets such as Queenstown.

Whilst a number of organisations provide multiple work-based training options and internships, there are also eight formal qualifications within the Tourism & Travel industry which support the industry to meet workforce need.

Industry are increasingly demanding short, sharp, stackable micro-credentials which could support businesses to provide more accessible training and for learners to upskill and develop more transferrable skills to help them progress within their careers. This includes potential micro-credentials for authentic storytelling.

In addition, there is a trend towards more hands-on learning over theoretical education with industry promoting apprenticeship schemes and government-supported internships. Industry emphasises the importance of practical, relevant and accessible training, as well as niche industry awareness and core skills such as critical thinking, customer service skills and communication.

Industry has highlighted other key challenges for industry training, including language barriers, funding availability, regional accessibility of training.

Explore Tourism & Travel industry workforce demographic, business, and economy statistics, and education and training data.

The increasing impact of cost of living has meant less household disposable income for leisure activities. As a result, many businesses are having difficulty attracting customers and competing for customer disposable income.

Recovery in international travel and the rising cost of living means tourism operators are needing to balance domestic and international offerings.

Businesses are therefore seeing a decrease in customers, less productivity, and increased cost, and some are facing closures.

More than a third of visitors travel to New Zealand in the summer months (40 percent of the total spend), but it can result in insecure seasonal jobs, overcrowding and congestion.

Tourism operators focussing on seasonal attractions such as winter leisure activities are increasingly seeking ways to appeal to Australian visitors to travel to and enjoy New Zealand activities compared to other international destinations.

Outside of peak season, hotel rooms are left empty, business return to skeleton staff and some hibernate, waiting for visitors to return over the warmer months.

Tourism New Zealand has an ambitious new strategy which will support this and grow tourism by $5 billion over the next four years by attracting more visitors outside of summer. The strategy highlights the importance of building New Zealand’s brand, enhancing the visitor experience and growing off-peak arrivals.

Industry has reported challenges recruiting from secondary schools and tertiary institutions and have noted the lack of life skills and experience, limited time for training, suitability of working hours, license and qualification requirements.

Organisations have also reported a shortage of quality applicants, followed by unrealistic expectations regarding accommodation for job seekers, discrepancy between available and work hours.

In addition, increased wages are impacting the ability of businesses to alleviate recruitment issues for their organisation.

Other recruitment challenges include time and funding constraints, immigration and visa restrictions, a limited talent pool in rural areas and inadequate wages in relation to living costs.

The specific roles most in demand are housekeeping attendants, customer service/frontline/reception workers and tour guides.

There are a number of roles that are suitable for short-term workers in destination tourism locations such as Queenstown, where domestic worker relocation is not viable but short term migrant worker placement may be suitable, however, many short term migrant workers do not have visa’s and need support.

The high cost of living and seasonal nature of tourism limits tourism destination towns’ ability to attract domestic workers. Fill labour shortage – short term need + short term solution. Many would like to hire domestic workers; however, recruiting domestically is not sufficient to meet the current labour shortage and increasing demand for tourism and travel offerings.

Ensuring the sustainability of Māori tourism involves nurturing a legacy with rangatahi and future generations of the industry.

This can be achieved by making tourism education more engaging and relevant, and by providing pathways that connect Māori values with practical skills. Empowering young people to take on roles within the tourism sector will preserve Māori stories and cultural practices, ensuring they are passed down and cared for appropriately.

Building and maintaining strong relationships within Te Ao Māori, Māori tourism networks and the wider community is crucial to the industry. This includes nurturing connections among Māori tourism operators, educators, and learners. Te Whakarae project aims to bolster relationships between Māori industry, collaboration with wider industry, and enriching communities with iwi, hapū and wider communities. This will support Māori Tourism and New Zealand Tourism collectively.

Manaakitanga is central to Māori tourism, emphasising the sharing of culture, traditions, and the environment through genuine hospitality. It offers a unique insight into Te Ao Māori and attracts both international visitors and local people, including those seeking to reconnect with their ancestral roots. Manaakitanga for Māori operators means delivering evxperiences according to their values so that visitors have enriching and meaningful experiences.

Centering the unique relationship of Māori and the environment means implementing tourism practices that minimise environmental impact such as conservation, waste management, reduced human interference of nature sites and natural resources. Collaboration between mana whenua, conservation organisations, wider industry and local government can support and promote kaitiakitanga across the industry.

Improving the quality of dialogue and narratives shared with guests enriches the cultural experience. Through authentic stories, visitors gain a deeper, more meaningful understanding of Māori culture and values at a level which is region specific and therefore iwi, hapū specific. This practice transforms a tourism experience into a journey through regional histories, allowing guests to connect with Māori and their relationship to whenua, moana and the natural environment. The power of storytelling lies in its ability to create emotional connections, making the cultural experience impactful and lasting.

As an example, food extends beyond sustenance; it is part of a narrative that tells the story of people and the land. Authentic kai, and the offering of food unique to Māori and New Zealand, embodies this concept. By providing dining experiences that reflect traditional Māori food sources, using locally sourced ingredients that connect to local stories, tourism operators not only provide nourishment but also a slice of history and whakapapa. This commitment to authenticity enriches the guest experience, making it not just a meal, but a cultural exchange. By sourcing ingredients locally, operators support regional producers and foster a symbiotic relationship between tourism and local food-related businesses.

Reducing high volume in exchange for small group experience tourism has meant extending operations to almost year-round, which provides a more sustainable business model for Māori tourism. This approach offers stable, year-round employment for staff, breaking the cycle of seasonal tourism. With consistent employment, staff can better plan for the long term, contributing to improved maintenance and care of whenua, moana, and the wider environment. Smaller groups mean lessening the environmental impact and educating visitors how to engage with a sustainable approach to tourism. This model supports the sustainability of both the community and the environment, allowing for better long-term planning and resource management.

Māori tourism focuses on authenticity, sustainability, and quality, providing a distinct point of difference to the international market while offering a blueprint for the future of cultural tourism in New Zealand. By prioritising authentic kai, small group interactions, enriched storytelling, and year-round operations, Māori tourism not only preserves its integrity but also provides a profound experience for visitors. This regional and local approach ensures that tourism benefits the community, the environment, and the visitors, creating a sustainable and authentic tourism model.

Technology can enhance the experience of travelers. Virtual Reality (VR) tourism is an idea of the future no longer, it is here already. Adventures such as extreme sports, caving, diving, theme park rides, museums are already incorporating VR into their products and experiences and using VR to promote the in-person experience to a wider audience.

Travel offerings are evolving to be increasingly online, a trend exacerbated by difficult trading conditions during Covid-19. Organisations with an online model typically have lower overheads, as they don’t need to operate shopfronts in major shopping strips that have substantial rent costs. In addition, by utilising online resources, Tourism and Travel businesses can promote their offerings more effectively and to a wider audience, for example:

Skills growth is key to elevating the quality of the tourism industry by ensuring a skilled and knowledgeable workforce, which in turn enhances the overall visitor experience and operational efficiency in tourism businesses.

Proactive approaches to recruiting, training, rewarding, and retaining employees, supports high employment standards and clear career pathways. Ensuring a continuous flow of skilled talent into the tourism industry through comprehensive educational pathways includes:

Industry has indicated that apprenticeship models are desirable, and in-work training models are successful for on-the-job training but more difficult to successfully implement within classroom-based training environments.

This has implications for the Service Sector and more specifically for the Tourism & Travel industry. It will change who services are delivered for and by. This means it will become even more important for industry to reflect its workforce and customers, and for that workforce to be more culturally aware. This will support industry to successfully attract and recruit more people into the workforce, ensure that those workers feel safe and valued within their roles, and help them to promote the customer experience and loyalty.

Each of these groups makes a unique contribution to the Service sector, and businesses will benefit from recognising this contribution and being responsive to their individual needs. With current labour shortages, developing a committed and responsive relationship with these groups

will help realise the proven economic and social benefits for employers, the workforce, and the wider communities in which services are delivered.

Approximately 13% of the industry is Māori.

The Māori workforce remains predominantly within recreation and arts, as well as accommodation and food & beverage services. The Māori workforce includes owner operators, self-employed businesses, as well as employees who bring Te Ao Māori values and/or Te Ao Māori skillsets to their work. Having identified approximately 530 Māori tourism businesses leading up to Covid-19, NZ Māori Tourism reported that half of the businesses among their networks adapted for new markets as a result of Covid, with 44% reducing the range of goods and services they offer. This impacted the Māori workforce, however, despite the challenges of the pandemic, by 2022, 74% of those businesses remained resilient post covid disruption providing some stability for the workforce.

Incorporating Te Ao Māori

Māori tourism businesses identify values as the foundation of their kaupapa underpinning their businesses. Additionally increasing Te Ao Māori practices across the board will build a better workplace environment for employees, where their values are acknowledged and identified as a strength. This will promote an industry with a robust Māori workforce that bring a wide skiillset associated with Te Ao Māori with them while making the industry more attractive to international visitors.

Authentic Story-telling

It is vital to embrace authentic stories as a feature of the industry. The industry contains many genuine, knowledgeable storytellers who have a connection to their whakapapa, and whenua who can incorporate Te Ao Māori views practices into their offerings. There is scope to spread this knowledge further as there are still cases of businesses sharing stories and history without consideration for their accuracy or cultural significance.

Connecting Māori across the industry

Connecting Māori within the industry ensures a wider pool of knowledge sharing and support across the industry. This fosters collective strategy, sustainable growth, cultural preservation and economic development within the sector.

Sustainable Tourism is Kaitiakitanga

Enacting kaitiakitanga through sustainable tourism practices is a key focus for Māori in the industry. Tiaki Taiao (Environmental practices) is a focus for Te Aō Māori in general, with Māori tourism actioning what it means for local iwi, hapū and communities in relation to visitors and reducing environmental impacts. Informing and sharing knowledge about better environmental practices embedded in visitor experiences spreads knowledge and understanding that is specific to local Māori and their local environment.

Approximately 6% of the industry is Pacific.

The impact of Covid-19 resulting in job loss and the low proportion of Pacific in the Tourism workforce is showing little to no signs of recovery. Similar to Manaakitanga, Pacific people are renowned for their values, which place importance on caring for guests and hospitality, providing an avenue to attract the Pacific workforce. Ensuring the industry is a viable career option and an attractive industry to work in for Pacific people can assist in growing the Pacific workforce and increasing the genuine and authentic dimension of tourism and travel services.

Cultural responsiveness

Ensuring the industry is receptive and responsive to cultural aspects of the Pacific workforce can increase the appeal of the industry to Pacific people and grow the workforce.

Skills development

Identifying where existing skills can be acknowledged and where skills can be developed further to encourage an agile Pacific workforce.

Enriching careers

Working with Pacific communities to understand how tourism skills sets are transferable within New Zealand and across the Pacific can contribute to the wider Pacific workforce.

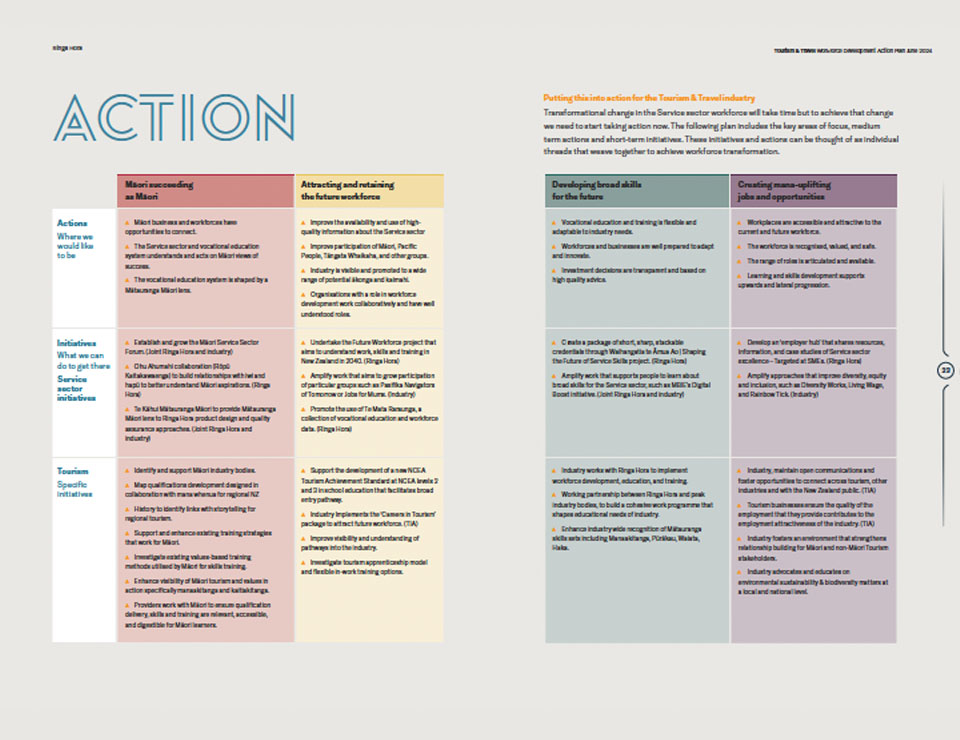

Transformational change in the Service sector workforce will take time but to achieve that change we need to start taking action now. The following plan includes the key areas of focus, medium term actions and short-term initiatives. These initiatives and actions can be thought of as individual threads that weave together to achieve workforce transformation.

Download our actions and progress: