Ringa Hora has worked with people from across industry to develop a shared roadmap to transform the Service sector workforce from its current state to the future that we aspire to.

The Workforce Development Plan looks across the Service sector and sets out the major factors shaping the sector and an overarching vision for the future.

Against that context, this Action Plan focuses on the characteristics and dynamics of the Real Estate & Rental industry and its workforce. It describes what the future could look like for this workforce, the current challenges faced by the industry, and sets out the actions we can take to tackle this wero | challenge.

Ringa Hora’s Service Sector Workforce Development Plan is based on four aho | strands. Each of these aho will strengthen the workforce, but when woven together, as a taura whiri | rope, we can achieve real transformation of the workforce:

For the Real Estate & Rental industry this looks like maintaining resilience in light of a constantly changing landscape that is highly dependent on external factors such as economic conditions and the regulatory regime.

A diverse mix of people and skills will stabilise the sector, building its resilience and ability to effectively adapt to any future changes or shocks. In addition, by better engaging with Māori and Pacific communities, more kaimahi will feel better reflected within the industry. In doing so, the Real Estate & Rental industry will challenge negative perceptions and become a trusted cornerstone of society.

The Real Estate & Rental industry is centred around people. Whether someone is buying or selling a home or commercial property, or searching for a suitable rental for business purposes or to house their whānau, they are often making the biggest investment of their lives. The biggest influence for this industry is how the workforce engage and deal with people making these decisions.

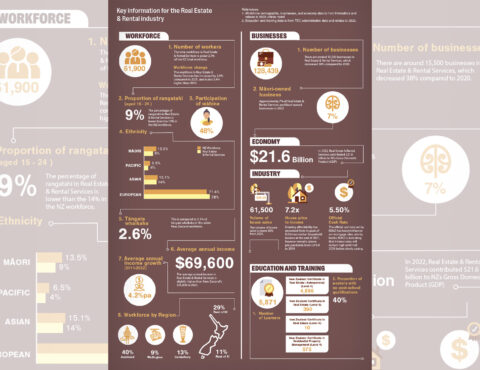

The Real Estate & Rental industry contributes $21.6 billion to the nation’s economy. Strong growth in residential housing prices supported industry performance in recent years. However, the industry is vulnerable to economic conditions and is frequently in the public spotlight due to the ongoing housing crisis, despite government intervention to contain price growth. High interest rates coupled with the recent fall in house sales has resulted in the decline in the number of active real estate licences.

Tax changes, rising interest rates and costs related to the healthy home standards have seen some property investors exit the market. Many landlords are also struggling with the Government’s decision to phase out interest deductibility. There is genuine concern in the industry that rental accommodation could become scarce if too many landlords exit the market.

The commercial property sector is facing similar conditions, while also responding to its own set of challenges and opportunities. For example, commercial tenants have increasing expectations for business premises to align with their own business environmental and sustainability priorities.

To help us get to the future state, we need to understand and tackle the challenges that the Real Estate & Rental industry faces, while also seizing the opportunities that already exist or are on the horizon. We’ve heard that the factors having a significant impact on the Real Estate & Rental industry, including its approach to workforce development, include retention, high financial costs, accessibility of the workforce for Māori and Pacific and regulatory changes.

Encouraging career pathways and progression for existing staff in the workforce

The Real Estate & Rental workforce has seen only modest growth in recent years, with decreases in some occupations within the industry. Anticipated falling property prices and growing interest rates likely mean limited employment growth in the industry in the coming years. However, there are growth opportunities at leadership level, with a need for more personnel in branch management.

The workforce has a strong sense of professional identity; with a distinction between real estate agents (salespeople) and residential property management. This, in turn, can mean different approaches to attracting and developing the workforce are required.

Addressing the high financial costs and risks of entry into the industry workforce

There are a range of upfront costs and on-going financial risks that may present barriers to entry and retention. The commissions-based nature of real estate is a barrier to attracting salespeople who may be seeking a regular, sustainable income or career. This is also a barrier to attracting Māori or Pacific employees. Qualification and licensing costs are another barrier to entry and to taking part in training. Not all employers are equipped financially to support work-based learning, especially for branch managers that must verify the work of salespeople. By exploring alternate models for entry, the industry could overcome some of these barriers, encourage greater diversity, and attract younger people.

Ensuring the industry is accessible for Māori and Pacific peoples

Māori and Pacific peoples have traditionally been under-represented in the sector, particularly in sales agent roles. Māori and Pacific peoples also have a shorter tenure within the industry. Many within these communities do not see themselves fitting in or being well represented in an industry that is sometimes perceived as placing ‘profit over people’. Māori and Pacific peoples are visual, and values driven who rely on word of mouth and community connections; therefore, perception is everything. There is a need to better engage with Māori and Pacific communities to understand and improve the level and nature of participation in the industry.

Adapting to new regulatory requirements for residential property management

Residential Property Managers will soon need to be registered, trained, and licensed under new legislation. This will require a significant change in practice and a step change in the level of training in the sector. This new legislation is likely to add a further 10% cost to businesses, including cost of licensing. It is estimated that around 80% of businesses will bear these costs for existing employees. For residential property management businesses that are already short-staffed, further study commitments may put unrealistic workload on existing property managers as well as increased operational costs. This is especially hard-hitting for smaller businesses which account for an estimated 30% of rental property management companies in New Zealand.

The Real Estate & Rental Services workforce employs around 61,900 people.

The industry involves professionals from various disciplines, including brokers, property managers, developers, and legal experts. The Real Estate & Rental industry is a great opportunity for those interested in business ownership; almost one-third of the sector are self-employed/employers. However, most firms operate as independent companies or as part of a franchise group, paying a portion of their gross revenue as royalties to a central franchise or entity.

Changing demographics mean that by 2038, more than 50% of the population will be Māori, Pacific and Asian. It is therefore important that the industry has an understanding of diverse cultures which means that the future workforce for the industry could look quite different to its customers. Embracing and celebrating this diversity makes businesses more attractive to potential kaimahi and customers, as well as creating economic and social benefits for employers, the workforce, and the wider community.

Using workforce participation data as a starting point shows that there is work to be done in the Real Estate & Rental Services industry to realise the aspirations and potential of Māori, Pacific peoples, and tāngata whaikaha | disabled people:

![]()

There is a lower proportion of Māori in Real Estate compared to Rental Services. This may be due to perceptions that Real Estate roles are misaligned with their values. Many Māori view housing as a social enterprise, something which does not match the growing regulatory environment of the industry. The industry needs to build cultural competency and promote a safe environment where Māori feel reflected.

![]()

The industry has a relatively low proportion of Pacific peoples, particularly in sales agent and branch manager roles. This is likely due to relatively high entry costs for potential kaimahi and

the perception that the industry is misaligned with Pacific values, particularly in the rental

services space. There are a small but growing number of Pacific-owned and run real estate businesses underpinned with Pacific values. There is an opportunity to support more of these businesses and encourage the wider industry to actively attract Pacific staff and create environments which empower them to succeed. In comparison, property management is perceived as more nurturing with a values driven, service-based approach which aligns more

with Pacific values.

![]()

Tāngata whaikaha includes physical, mental, intellectual, or sensory impairments which can impact a person’s life to varying degrees and in different ways. The industry recognises a general understanding of the housing needs of tāngata whaikaha | disabled people, however attraction of tāngata whaikaha into the sector is less visible, nor a priority, with tāngata whaikaha accounting for only 2.6% of the industry workforce.

Explore the Real Estate & Rental industry workforce demographic, business, and economy statistics, and education and training data.

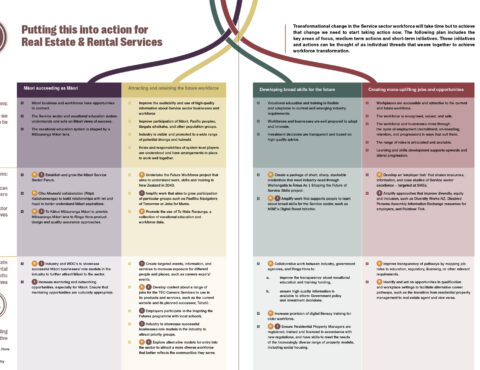

Transformational change in the Service sector workforce will take time but to achieve that change we need to start taking action now. The Real Estate & Rental action plan includes the key areas of focus, medium-term actions and short-term initiatives. These initiatives and actions can be thought of as individual threads that weave together to achieve workforce transformation.