Ringa Hora has worked with people from across industry to develop a shared roadmap to transform the Service sector workforce from its current state to the future that we aspire to.

The Workforce Development Plan looks across the Service sector and sets out the major factors shaping the sector and an overarching vision for the future.

Against that context, this Action Plan focuses on the characteristics and dynamics of the Financial & Advisory industry and its workforce.

It describes what the future could look like for this workforce, the current challenges faced by the industry, and sets out the actions we can take to tackle this wero | challenge.

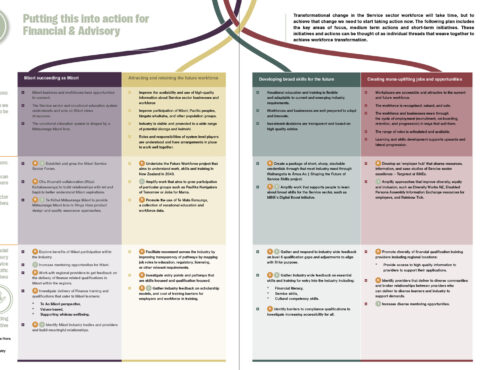

Ringa Hora’s Service Sector Workforce Development Plan is based on four aho | strands. Each of these aho will strengthen the workforce, but when woven together, as a taura whiri | rope, we can achieve real transformation of the workforce:

The industry is resilient and adaptable; the workforce is prepared for upcoming changes in the industry including legislative and regulatory changes, and the opportunities to shift from routine and manual tasks towards high-value-add activities that emerging technologies will enable.

For the Financial & Advisory Services industry, this is a future in which Māori can see themselves reflected in the way industry operates and in the workforce.

A resilient industry also needs a workforce who are enabled to choose and move into opportunities with support from their employers and an accessible vocational educational system.

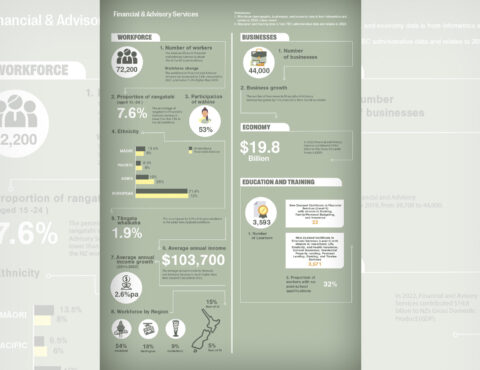

Financial & Advisory services are a core component of everyday activity in New Zealand contributing $19.76b to the economy.

Financial & Advisory services include insuring your car, seeking advice on investing your Kiwisaver, and even using your bank card at the dairy when buying milk.

These activities are all things that businesses, individuals and communities rely on to function in their day to day lives.

The industry is highly regulated, which has resulted in a large growth in employees seeking and achieving qualifications over the last 18 months. Given that protecting people’s money and financial wellbeing is a very personal and high trust service, the industry wants to continue to raise the professionalism and credibility of people working in the industry. It is therefore important that qualifications are relevant and reflect current standards to meet these regulations.

To help us get to the future state, we need to understand and tackle the challenges that the Retail & Distribution sector faces, while also seizing the opportunities that already exist or are on the horizon. We’ve heard that the factors having a significant impact on the Retail & Distribution industry and its approach to workforce development include rising inflation and wage increases, a shortage of labour exacerbated by high turnover, technological advances and changing consumer demands, and rising retail crime.

Addressing skills and labour shortages

In recent years, there has been a gradual increase in demand for Financial & Advisory Services, however with an aging workforce and therefore increasing numbers retiring, there are gaps in the industry’s ability to respond to the demand. The number of workers aged over 55 has increased from 9,800 in 2015 to 13,400 in 2021. Over the same time period, the workforce aged under 25 has decreased from 7,200 to 6,000.

Upcoming changes in legislation, particularly in the area of financial advice services, are prompting some self-employed individuals to consider changing industries. Therefore, creating a pipeline of new entrants is critical to meeting this expected turnover. Currently many entrants into the industry come from the banking sector. The industry has also identified interest in changing immigration settings to allow more migrants into the sector.

Promoting career pathways within the workforce

The current workforce has built a skillset and trust based on experience, which takes time. People in the workforce can work their way up, however, the pathway in and through the Financial & Advisory industry is not easy to define or understand. Many roles in the sector are commission-based and it takes many years of experience to earn a high income. Clearer entry pathways are needed to ease mobility and improve access into high earning roles within the Financial & Advisory industry.

Developing fit for purpose training and qualifications

New regulations have raised concerns about the alignment between regulatory requirements,

industry expectations, and vocational education settings. Although we have heard from industry that regulation and process are needed, we have also heard perceptions that the current changes do not address barriers into the industry, and don’t focus on skills-based training which the industry desires. The reforms have resulted in a huge demand for training and qualifications; enrolments in the New Zealand Certificate in Financial Services increased from under 800 in 2018 to 3,593 in 2022. Many of the enrolments have been working in the industry for some time and are seeking retrospective recognition of their skills, knowledge, and attributes. This is a different approach and set of expectations from what would be the case if the increased demand was driven by an influx of new entrants to the sector.

Promoting the visibility and appeal of the industry to diverse candidates

Industry is seeking a more diverse workforce to seeking a more diverse workforce and meet the needs of customers who reflect the various cultures within New Zealand. Industry would like to grow wealth, but currently there is a small percentage of the population which has access and knowledge of Financial & Advisory Services.

Attracting more Māori

Industry would like to attract more Māori within the industry, and service regional community needs. Those kaimahi Māori in the industry believe that this change in the workforce will be critical if they wish to grow intergenerational wealth, and sustainable futures.

The Financial & Advisory industry is a high trust environment, with a number of self-employment options however, many kaimahi also work in full-time employment for banks, insurance companies, and consultancies. This core workforce accounts for approximately 72,200 people.

In this industry many workers will gain valuable transferable skills including finance management, customer service, sales experience and communication skills. These skills support the workforce throughout their careers to develop and progress within their chosen pathways.

Embracing and celebrating diversity makes businesses more attractive to potential kaimahi and customers, as well as creating economic and social benefits for employers, the workforce, and the wider community.

Using workforce participation data as a starting point shows that there is work to be done in the Financial & Advisory industry to realise the aspirations and potential of Māori, Pacific peoples, and tāngata whaikaha | disabled people:

![]()

The Financial & Advisory industry is emerging as an attractive and necessary career choice for Māori. This is not only due to its role in helping to protect and grow the significant iwi asset base, but also plays out at whānau level; for example, how insurance provides peace of mind in good times and protection in times of adversity. Māori within the banking space have established a collective, the Tāwhia Māori Banking Network, to address key issues for Māori within the banking sector and to focus on greater impacts for whānau in the financial space. One of their key focus areas is Māori employment and career development in the banking sector.

![]()

There is a relatively low proportion of Pacific peoples in the Financial and Advisory workforce. This could be due to a limited understanding of possible career progression for Pacific peoples in the industry. In addition, Pacific peoples want to work in industries where they feel represented and where there is culturally receptive support. Another key factor is the accessibility of training and support required to help Pacific workers progress through the industry. Tailored training can be a key method to address this.

![]()

Tāngata whaikaha includes physical, mental, intellectual, or sensory impairments which can impact a person’s life to varying degrees and in different ways. We acknowledge that data on tāngata whaikaha is limited and it is important that we create more growth opportunities within the sector for our tāngata whaikaha workforce.

Explore Financial & Advisory industry workforce demographic, business, and economy statistics, and education and training data.

Transformational change in the Service sector workforce will take time but to achieve that change we need to start taking action now. The Financial & Advisory action plan includes the key areas of focus, medium-term actions and short-term initiatives. These initiatives and actions can be thought of as individual threads that weave together to achieve workforce transformation.