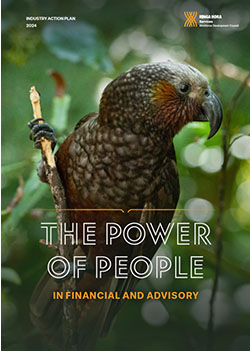

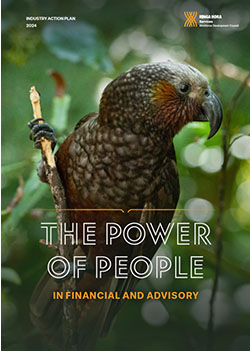

This year our visual theme for each of the Industry Action Plans has been developed with a Te Ao Māori context in mind.

For the Financial and Advisory industry we lean into the nature of the kākā. The kākā’s diligence in seeking food, solving problems, and its strategic foraging parallels the careful analysis and thoughtful decision-making of financial advisors.

The future of financial advisory services in New Zealand remains dynamic and client focused, driven by technological advancement, consumer expectations, and fit-for-purpose regulatory frameworks. Technological advancement will enhance data-driven insights and operational efficiencies, allowing advisors to focus on complex financial planning and personalised advice. As the regulatory environment continues to evolve to emphasise consumer protection and high standards, continuous professional development for advisers will be paramount to maintain transparency and trust.

With the integration of new technologies into the sector, there will be potential for the creation of new job prospects and training opportunities to enhance and diversify their skills.

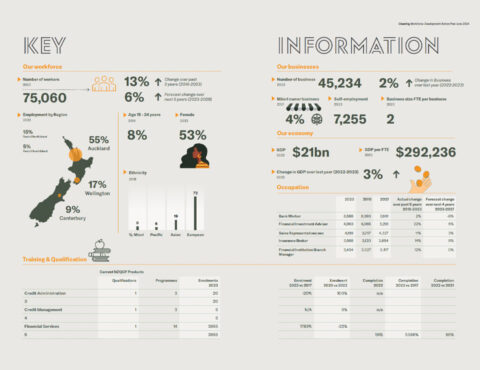

The Financial & Advisory services sector is integral to daily life in New Zealand, contributing $21 billion to the economy. This industry includes a broad array of services such as investment advice, retirement planning, insurance, mortgage broking, and daily banking activities. These services not only support individual financial health but also underpin the financial stability and prosperity of businesses and communities across New Zealand.

The industry is subject to strict regulations, aimed at protecting consumers and maintaining high standards of professionalism. In recent years, there has been a marked increase in financial advisers obtaining qualifications to meet these standards, reflecting a commitment to trust and credibility in the industry. Consequently, it is crucial that qualifications remain relevant and aligned with current standards to comply with these regulations.

The Financial & Advisory industry is a highly-flexible environment, with a number of self-employment options; however, many kaimahi also work in full-time employment for banks, insurance companies, and consultancies. This core workforce accounts for approximately 75,060 people. In this industry, many workers will gain valuable transferable skills, including finance management, customer service, sales experience and communication skills. These skills support the workforce throughout their careers, helping them to develop and progress within their chosen pathways. Embracing and celebrating diversity makes businesses more attractive to potential kaimahi and customers, as well as creating economic and social benefits for employers, the workforce, and the wider community.

Recent regulatory change in the financial advisory sector had led to a 45% surge in qualification enrolments between 2020 and 2022. Most in the industry agree that having a baseline minimum requirement is beneficial, as it demonstrates that those with the qualification are competent and skilled in providing sound advice. Additionally, these regulatory changes have increased consumer confidence when dealing with financial advisors.

The Level 5 Financial Services qualifications (2315) experienced an 89% increase in enrolments during the same period. The review process for this qualification concluded in May 2024, while reviews for Credit Administration Qualifications (2765, 2766) are currently in progress. Ringa Hora is overseeing all reviews in collaboration with key industry stakeholders, including associations, employers, and providers, to ensure expertise and guidance throughout the process.

Explore Financial & Advisory industry workforce demographic, business, and economy statistics, and education and training data.

The nature of the industry continues to evolve with an increasing focus on digital and flexible services – shifting away from fixed branches. This meant a constant demand for ongoing up skilling.

In addition, there are pre-requisite qualifications which can be a barrier to entry for some.

The Financial and Advisory industry is not seen as an attractive industry to be part of,

nor are there clear pathways into the industry, with a limited awareness regarding the diverse career opportunities available within the sector.

The Financial and Advisory industries have extensive and often complex regulations.

For example, in Banking This has been evolving over the past few years with Anti-Money laundering (AML), risk management and consumer protection. Navigating these regulations requires a deep understanding of the regulation compliance for banks.

In addition, under the recent regulatory regime, all advisors who provide financial advice were required to attain the NZ Cert in Financial Services (Level 5). This led to a mass exodus of the industry over the period of 2021-2023.

Increased regulations have resulted in financial institutes improving practices to keep up with these changes. Increased regulations also have a financial impact on financial institutes, especially for the smaller organisations.

The evolving nature of AI has led to organisations to rethink on how they can better utilise this tool. Increasing usage of AI to do back office/manual task has made it more seamless and effective for organisations. This has a domino effect as people previously doing those roles are forced out of a job. This creates an opportunity to pathway those back office/admin people into becoming a financial advisor.

Given the sensitive nature of the data banks handle from customer details to financial information and the ever-increasing cyber-attacks not only in New Zealand but globally, banks are actively working to improve their cyber security processes and technology. This is an area the banks are heavily investing in.

Tāwhia Māori Bankers’ Rōpū

The creation of Tāwhia addressed a recognised gap in communication and collaboration between Māori communities and the banking sector. While the banking industry plays a crucial role in financial well-being, statistics have shown a disparity in access to capital, workforce representation, and financial literacy among Māori. Tāwhia emerged as a platform for Māori banking professionals to raise Māori financial issues/opportunities of relevance, share ideas, advocate for Māori within the banking system, and bridge the gap between Te Ao Māori and banking practices.

Building a More Inclusive Financial Future

Tāwhia initiated three pou, being their key areas of focus:

Productivity in business means being able to do more, with fewer people. Businesses with high productivity are more resilient, able to adapt to changes more easily and promote growth and innovation. High business productivity per capita means an improved wellbeing by increasing the nation’s income and our ability to produce and afford the goods and services that underpin a happy, healthy life.

Technology is transforming the Financial & Advisory industry in New Zealand, boosting productivity and efficiency through:

This has implications for the Service Sector and more specifically for the Financial & Advisory industry. It will change who services are delivered for and by. This means it will become even more important for industry to reflect its workforce and customers, and for that workforce to be more culturally aware. This will support industry to successfully attract and recruit more people into the workforce, ensure that those workers feel safe and valued within their roles, and help them to promote the customer experience and loyalty.

Each of these groups makes a unique contribution to the Service sector, and businesses will benefit from recognising this contribution and being responsive to their individual needs. With current labour shortages, developing a committed and responsive relationship with these groups

will help realise the proven economic and social benefits for employers, the workforce, and the wider communities in which services are delivered.

There are approximately 6,000 Māori workers within the Financial and Advisory workforce. This makes up around 8% of the industry overall. Māori workforce numbers have declined by about 16% between 2018 and 2023.

The Māori workforce in financial advisory services in New Zealand is small but significant. Māori financial advisors bring cultural understanding, fostering trust with Māori clients through whānau-oriented approaches. Increasing Māori representation in financial roles enhances diversity and provides role models. Challenges include improving access to education and training, mentorship, and cultural competence in institutions. By addressing challenges and leveraging opportunities, this workforce can continue to grow and make a significant impact on both Māori communities and the broader economy.

Cultural Competency and inclusion

Ensuring that the workplace respects Māori cultural values, traditions, and practices. This includes recognizing important Māori cultural events and providing a culturally sensitive environment.

Implementing training programs for all staff to understand Māori culture, enhancing communication, and fostering an inclusive work environment.

Encouraging the integration of Māori perspectives and knowledge in business practices, policies, and client interactions. This might include promoting Māori-led financial initiatives or services tailored to Māori communities.

Attraction into the industry

The Financial & Advisory industry is emerging as an attractive and necessary career choice for Māori. This is not only due to its role in helping to protect and grow the significant iwi asset base, but also plays out at whānau level; for example, how insurance provides peace

of mind in good times and protection in times of adversity.

Representation

Promote awareness of cultural obligations and the importance of leaders authentically appreciating and understanding different cultures. Educate the workforce when it comes to celebration and significance of traditional events during the year.

There are approximately 4,500 Pacific workers within the Financial and Advisory workforce, making up around 6% of the industry overall. Pacific workforce numbers remained relatively unchanged between 2018 and 2023.

The Pacific workforce in financial advisory services in New Zealand is small, but there is growing demand for their expertise to serve the increasing Pacific population in New Zealand. Pacific advisors bring cultural understanding, fostering trust and providing tailored advice. Their presence increases diversity, serves as role models, and encourages youth. Addressing education, training, and cultural competence challenges is essential to meet the needs of the Pacific population and to ensure the sector’s growth and impact.

Cultural awareness

Pacific peoples want to work in industries where they feel represented and where there is culturally receptive support.

Encourage leadership to promote the strengths of a culturally diverse work environment. Promote the strength of religious and family values within the Pacific communities. And how this has a positive effect on the community.

Skill development initiatives

Promote funding and initiatives to support with soft skills. Encourage career progression and advancement into leadership roles.

Attraction into the industry

The financial advisory industry is an attractive and essential career choice for Pacific people. With a growing Pacific population and increasing needs the need to protect and grow family assets, there is a rising demand growing need for financial literacy and security advice. For instance, For example, understanding how insurance provides peace of mind during prosperous times good times and protection during adversity is crucial. To meet the needs of the future Pacific population, an increased Pacific workforce in this sector is necessary.

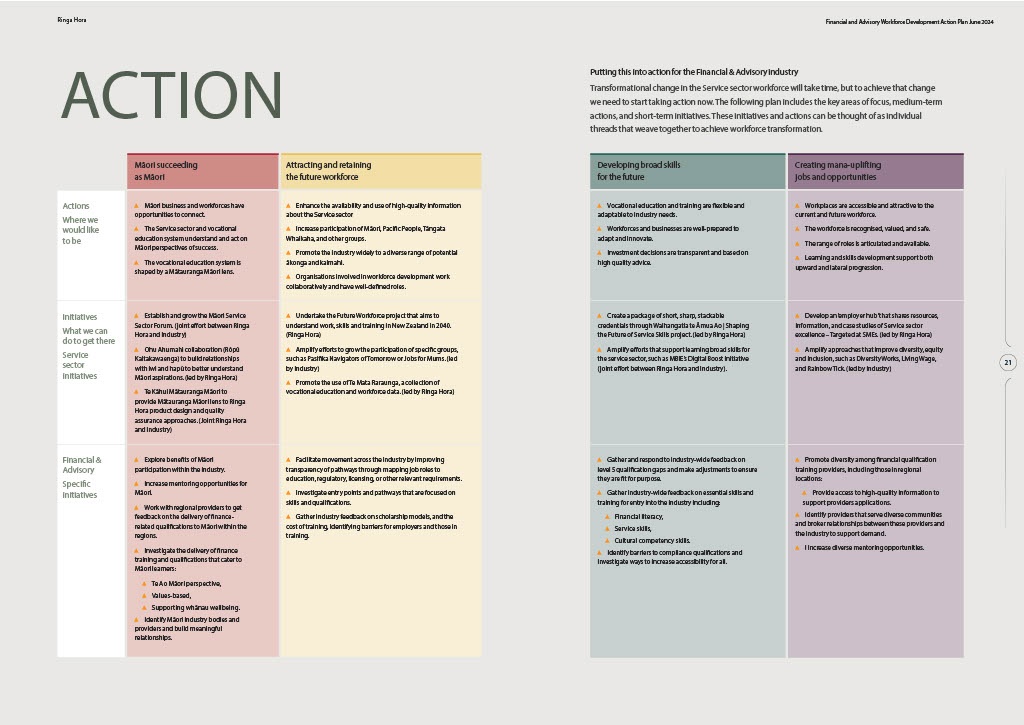

Transformational change in the Service sector workforce will take time, but to achieve that change, we need to start taking action now. The following plan includes the key areas of focus, medium-term actions and short-term initiatives. These initiatives and actions can be thought of as individual threads that weave together to achieve workforce transformation.

Download our actions and progress: