Ringa Hora Workforce Development Council, in conjunction with Building Service Contractors of New Zealand, undertook a deep dive into the Cleaning industry workforce through detailed quantitative research and a series of interviews with people across the industry.

We are deeply grateful for all of the insights and expertise shared with us by passionate Cleaning professionals and want to acknowledge their significant contribution to this project. The report also reflects input from the BSCNZ Cultural and Training Advisory Committee, whose members bring a combined industry experience of over 130 years.

This report summarises key findings from the project and presents actions and recommendations for change. The expertise and lived experience of the people who have contributed to this report have been invaluable in shaping recommendations that are practical, relevant, and future-focused.

To create change, we believe the Cleaning industry needs to work collectively to strive for:

A detailed set of recommended actions is included at the end of this report.

The cleaning industry is a vital part of Aotearoa New Zealand’s economic and social infrastructure. It underpins the safe operation of businesses,

communities, and essential services.

During the COVID-19 pandemic, the critical role of cleaning services became especially evident – ensuring that public, private, and commercial environments remained hygienic and safe. In more recent years, tough economic conditions and rapidly rising prices have placed a strain on both businesses and workers.

In this environment, it can seem difficult to focus on the workforce, but doing so is critical to business success and long-term industry sustainability.

800 students

40 classrooms

Entire schools reset overnight

The industry contributed approximately $1.6 billion to New Zealand’s GDP in 2023 and directly employed an estimated 52,700 workers during the tax year ended March 2024. It is deeply interconnected with other sectors – such as tourism, hospitality, retail, healthcare, and education – that are considered key pillars of the national economy.

The Cleaning industry provides opportunities for meaningful employment, entrepreneurship, and deeply human work that holds responsibility and mana. There are many businesses actively working to lift the professionalism of the industry through training, standards, and embedding ethical practices.

Much of the work of the industry takes place away from the public eye – once people have left their office for the evening or checked out of a hotel. This lack of visibility means many take Cleaning, and Cleaners, for granted.

It also makes it easier for rogue operators to continue poor practice and at the extreme, exploit vulnerable workers through low contract rates and unrealistic service expectations.

There has been an emerging narrative about the impacts of franchising in the industry, and particularly about the practices of a few franchisors. Throughout this report, we have included a strand focusing on franchises to increase understanding of where any issues lie, the impact this has on the industry as a whole, and any actions that might be taken.

This plan details current trends and challenges facing the industry, outlines the Cleaning industry ecosystem, provides detailed data about Commercial Cleaning, and outlines a series of suggested actions to reduce poor practice, uplift Cleaners, and help ensure the long-term sustainability of the cleaning workforce.

40,000

visitors weekly

Standards maintained constantly

Hygiene maintained

through constant traffic

The Commercial Cleaning industry is undergoing significant transformation, driven by technological advancements, evolving client expectations, and environmental considerations. One of the most notable trends is the integration of technology into cleaning operations. While automation and smart tools are not expected to replace cleaners, they are reshaping the nature of their work. Cleaners are increasingly required to operate and manage equipment such as robotic vacuums, sensor-based systems, and digital scheduling tools. This shift enhances the consistency and quality of service but also demands a higher level of digital literacy and adaptability from workers.

In contrast to the heightened hygiene protocols during the COVID-19 pandemic, there has been a noticeable decline in demand for intensive disinfection. Many clients have reverted to standard cleaning routines, although there remains a residual expectation for visible cleanliness, particularly in high-traffic areas. This change may reduce the pressure on cleaners but could also lead to fewer hours or reduced scope in some contracts.

The rise of smart buildings is also influencing the scope of cleaning work. These buildings use real-time data, such as occupancy sensors, to determine which areas require attention. As a result, cleaning tasks can vary significantly from day to day. Cleaners must be flexible and responsive, often receiving updates through mobile apps or communication platforms. This dynamic environment requires a workforce that can quickly adapt to changing priorities and workloads.

Another emerging trend is the use of geo-specific tracking apps to monitor who is on-site and where they are working. While this enhances safety and accountability, it also introduces a new level of oversight and is a challenge for cleaners who don’t have a smart phone or share a phone between family members. Cleaners must be comfortable using these apps, which adds another layer of digital competency to their role. At the same time, this technology can help verify task completion and improve coordination across teams.

Employers are also placing greater emphasis on soft skills such as adaptability, problem-solving, and communication. As cleaning roles become more complex and customer-facing, these higher-level skills are increasingly valued. Cleaners who develop these competencies may find more opportunities for career progression and recognition within their organisations.

Finally, environmental sustainability is becoming a key consideration in commercial cleaning. There is a growing shift away from harsh chemicals toward more

eco-friendly alternatives, including steam cleaning. This not only reduces environmental impact but also improves health and safety conditions for cleaners. However, it requires them to learn new techniques and understand sustainability protocols, positioning them as important contributors to green building practices.

The wider Cleaning industry includes many different aspects of cleaning from cleaning offices to hospital rooms to street sweeping. It includes businesses whose main business is cleaning, and also a large number of cleaners who are employed directly by businesses such as hospitals or hotels. This report focuses on Commercial Cleaning and also touches on Healthcare, Aged Care, Accommodation, and Domestic Cleaning.

Early mornings, late evenings

and weekends

Work that maintains standards

when no one is watching

The Commercial Cleaning sector is highly fragmented, with a mix of direct employers, franchise operators, and sole traders. Franchise models have introduced competitive pressures, downward pressure on prices and unrealistic service expectations. Independent small and medium-sized enterprises (SMEs) are losing market share to large companies, some of which are overseas-owned and have undergone multiple ownership changes, raising concerns about long-term stability and local accountability.

The industry is grappling with profit margins amid a flat economy. Businesses are responding by reducing cleaning frequency and scope, which affects both service quality and workforce hours. Supplier price increases further strain budgets. Some companies have diversified into adjacent services like garden care and residential cleaning to remain viable.

Regulatory frameworks such as Part 6A of the Employment Relations Act require new contractors to retain existing cleaners under previous conditions, which can complicate workforce management. Additionally, rising minimum and living wages, while beneficial for workers, add financial pressure to businesses operating on thin margins.

Shifts in workplace dynamics – such as increased remote work, smaller office footprints, and shared spaces – have reduced demand for traditional cleaning services. Rising lease costs are also pushing small businesses out of physical premises, further impacting cleaning contracts.

Economic pressures and a lack of awareness about cleaning’s costs and the value of certification mean many businesses choose based almost solely on price when procuring cleaning services. This can drive down prices to the point where some cleaners are effectively working for less than minimum wage, particularly owner-operators who are paying themselves dividends based on their profits. Cleaners who are directly employed also lose income through reduced hours as companies reduce scope to win contracts, or lose contracts altogether.

Government syndicated contracts centralise procurement under a lead agency, making it difficult for smaller suppliers to compete. These contracts often favour large providers and contribute to market consolidation. Currently, many of these contracts sit with overseas-owned companies, with some Kiwi-owned companies feeling unable to access Government contracts. Additionally, discrepancies in wage requirements between government (living wage) and private (minimum wage) contracts create inequities.

Safety considerations are increasingly top of mind for Cleaning industry employers. This includes physical health and safety of workers such as lifting and carrying or use of chemicals, and the mental health and wellbeing of employees. Security of vulnerable, lone workers in the cleaning sector is also being recognised as a challenge. Cleaners are faced with security challenges such as cleaning in remote areas of public parks, transport hubs, drunk and drugged members of the public and gangs of young people.

Formal NZQA Training in the commercial cleaning sector is limited and poorly supported. Most trainees are concentrated in hospital and aged care settings, with only a small number of commercial cleaning businesses engaged in credentialised work-based learning. Supervisory skill gaps are common, especially as cleaners often work in isolation. Barriers to training include language and literacy challenges (ESOL, LLN), time constraints, lack of supervision, low profitability, high staff turnover, and the perception that training does not help secure customer contracts.

There are some challenges that are unique to different parts of the country. In remote parts of the country there can be difficulties accessing wifi and other technologies which is difficult as company systems increasingly move online. Outside of the main centres cleaning companies are often covering a wider geographical range which can create challenges if cleaners are away or work changes. Some challenges are regionally unique. For example, remote parts of New Zealand still experience difficulties with internet connectivity, meaning that company systems and other online technologies may be inaccessible to workers or inconsistently available for use. Outside of the main centres cleaning companies often service a wider geographical range, which can create coverage challenges if cleaners are away or work changes. Seasonal industries in some regions can also have an impact — both increasing demand for cleaners in regions with significant seasonal tourism, and people leaving cleaning jobs to work in more profitable, short-term roles such as fruit picking.

Residents deserve hotel-quality standards

Personal spaces maintained with respect

Professional care in

environments people call home

There has been media attention and a wider narrative about the negative impact of franchises on the Cleaning industry and the Cleaning workforce. But is franchising actually the issue? Or are there some bad operators with poor practices that are tarnishing the wider industry?

Franchise businesses have been part of the Cleaning industry in New Zealand for decades. There are well-established and well-respected, franchisors who offer opportunities for people to own their business with reduced barriers to entry, by providing support around them, brand recognition, training, and contracts.

However, there are also a small number of really poor operators in the industry which, at the most extreme, exploit the aspirations of vulnerable people. In the worst cases, people are receiving cleaning contracts that give them effective earnings well below minimum wage, are given far less work than they expected and are tied into punitive agreements.

The practices of these operators are obviously harmful for franchisees, but also impact the entire industry by both damaging public perception and undercutting pricing of businesses that are meeting legal obligations and operating in an ethical manner.

Franchising in itself isn’t good or bad, instead it offers a different business model, which gives people choices depending on their different motivations around what they want from work.

4,000 square

metres maintained nightly

200 workstations

ready every morning

Standards that

never slip

7,782

64% increase since 2014

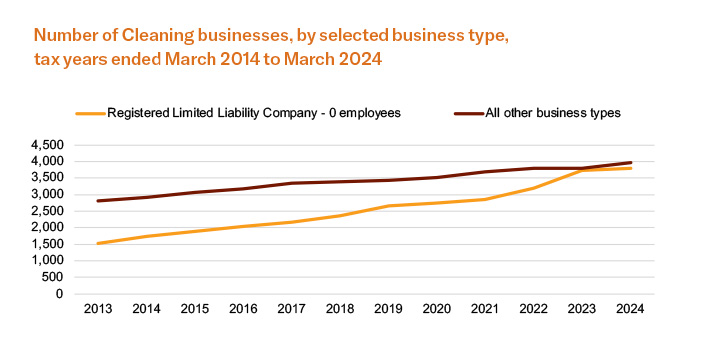

The number of Cleaning businesses has rapidly grown in the past 10 years, from 4,788 in the tax year ended March 2014, to 7,782 as at the end of the tax year ended March 2024. Yearly growth averages were between 3% and 8% during this period. This is a considerably higher rate of growth than across all New Zealand businesses.

2/3

Approximately two-thirds of cleaning businesses have zero employees

“Zero employee” companies do not have any people that work for them full-time but are instead commonly run by working shareholders (who own and operate the business), and/or part-time and casual workers who collectively work less than one full-time equivalent (defined as 40 hours of employment per week). These businesses are referred to as “0 FTE”.

=0 FTE

Growth driven by increasing 0 FTE registered companies

As of the tax year ended March 2024 there are now 2,289 more 0 FTE Registered Limited Liability Companies than there were for the tax year ended March 2014. This accounts for two-thirds of the increase during this period.

Business performance varies considerably by business size

52,700

18.7% Increase since 2014

The total number of workers involved in the Cleaning industry was 52,700 for the tax year ended March 2024, an increase of 18.7% compared to the tax year ended March 2014. Total workers increased up until the tax year ended March 2019, and have bounced around since then.

There are slightly more females than males in the industry (54% compared to 46%), with a relatively stable split since 2013.

In the 2023 Census 6.2% of workers in the Cleaning industry identified as having a disability, markedly higher than 4.1% of people in the total New Zealand workforce who identify as having a disability.

47%

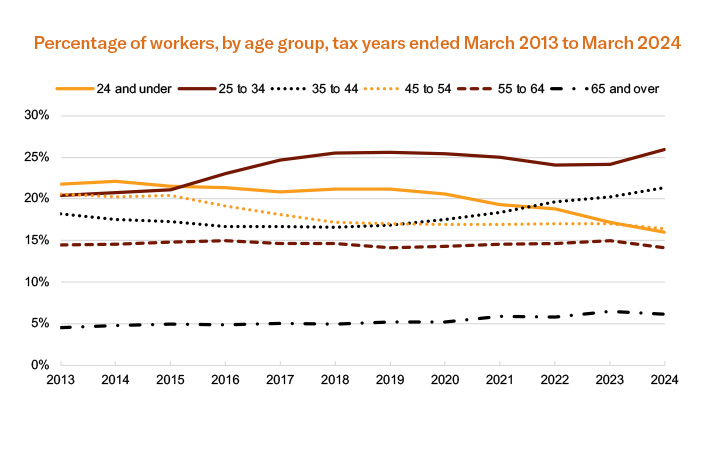

The proportion of workers in these age groups, as well as workers aged 65 and older, has been increasing over time. By contrast, the proportion of workers aged 24 and under, and 45 to 54 has been decreasing.

32%

identifiying as Asian

7%

Middle Eastern, Latin American or African

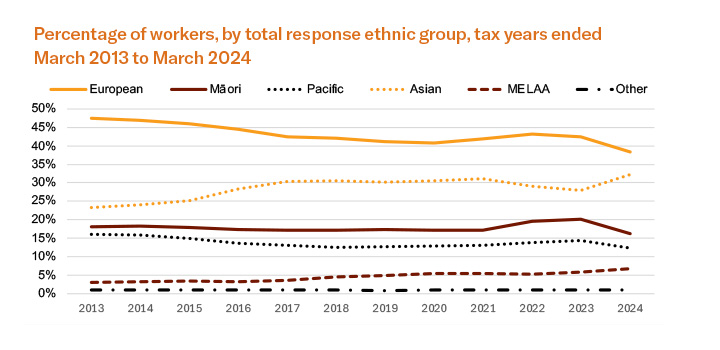

The proportion of workers who identify as European and Pacific has been decreasing, while the proportion of workers who identify as Asian or MELAA has been increasing over time. 32% of workers in the Cleaning industry in 2024 identified as Asian, and a further 7% identified as MELAA (Middle Eastern, Latin American or African).

56%

New Zealand Citizens

44%

Other

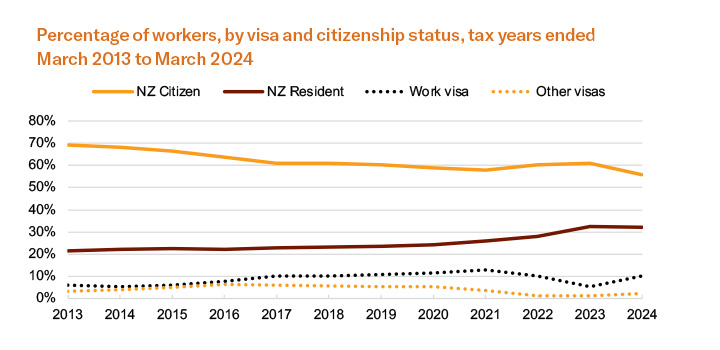

The percentage of workers who were New Zealand citizens has been falling over time, while the proportion of workers with New Zealand residency or work visas has increased. In 2024, 56% of workers in the industry were New Zealand citizens, 32% were New Zealand residents, and 12% were on work or other visas.

24-hour lobbies

Constant arrivals and departures

Professional standards

maintained through continuous motion

Unfortunately, there is no specific measure in official datasets to identify businesses that are franchises. However, the rapid growth of companies with 0 FTEs

along with their other characteristics and knowledge about the industry, makes us believe that many of them are franchises.

This profile is consistent with the industry narrative about the increase of franchise businesses having a large proportion of new Kiwis, some of whom are buying a franchise as a pathway to company ownership.

The combined impact of the challenges facing the industry is that many businesses are feeling under pressure and focusing on survival. When facing these challenges, it can seem difficult to focus on the workforce, but doing so is critical to business success and long-term industry sustainability.

To enable the Cleaning industry to respond to current challenges and ensure a vibrant future, the industry needs to work collectively to strive for:

Address rogue operators and worst practice

Work collectively to lift industry standards

Create platform to increase accessibility to industry data

Encourage better procurement practices

Uplift public perceptions of Cleaning and Cleaners

Create wraparound support for people starting independent SME Cleaning businesses

Training, Career Development and Education

52,700 workers

maintaining professional standards across

hospitals, schools, offices, and public spaces.

Work that happens largely out of sight,

that underpins how our country operates.

Essential infrastructure.

Professional workforce.